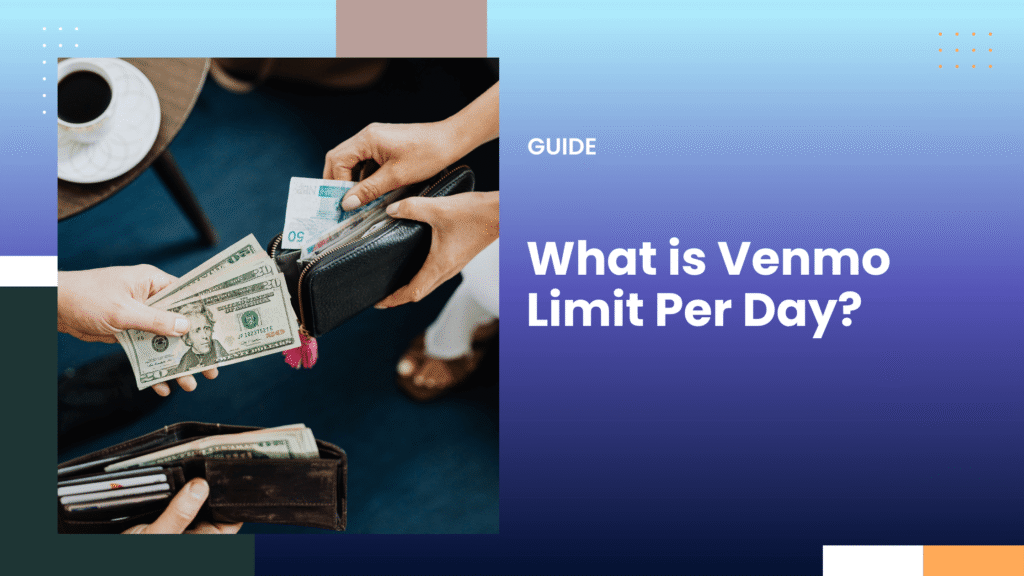

Venmo limit per day depends on weekly limits. Verified users can send up to $60,000 weekly (about $8,571/day), while unverified users are capped at $299.99/week. Though there’s no strict daily limit, transaction caps and Venmo debit card rules affect daily sending and spending.

What is Venmo Send Limit Per Day?

Venmo doesn’t set a specific daily limit for sending money. Instead, it follows a weekly limit system.

Here’s how it works for you:

- Verified Users: You can send up to $4,999.99 per week. If you averaged it out, that’s roughly $714.28 a day.

- Unverified Users: Your limit drops to $299.99 per week, which is about $42.85 daily.

The amount you can send includes person-to-person payments and payments to authorized merchants.

You can send up to $60,000 weekly if you’ve completed identity verification, but your transactions are limited by this weekly cap.

- For purchases, the maximum per transaction is $2,999.99.

- If you’re using a Venmo Debit Card, be mindful of additional spending limits.

How to Increase Your Venmo Limits?

To raise your limits, complete your identity verification and follow the steps in the app under your account settings.

- Open the Venmo app.

- Tap on the menu icon (☰).

- Go to Settings > Identity Verification.

- Fill in your full legal name, date of birth, address, and the last four digits of your Social Security Number (SSN) or ITIN.

- Submit the information; Venmo will review it, usually within minutes to a few days.

Once verified, you can see significant increases in your limits:

- Verified Account Limits for Sending Money: Up to $60,000 per week.

- Verified Account Limits for Purchases: Up to $7,000 per week.

This process empowers you to use Venmo more effectively for larger transactions. Always ensure your information is accurate to avoid delays in verification.

What is Venmo Receive Limit Per Day?

Venmo sets limits on how much money you can receive in a single day. Here’s a breakdown:

- For Unverified Accounts: The limit is typically $299.99 per day. If your account isn’t verified, you’ll face lower limits.

- For Verified Accounts: Once verified, you can receive up to $5,000 per transaction. The total you can receive in one day can reach this amount.

How Does Venmo Limit Reset?

- Limits Reset: These limits reset every 24 hours. After this period, you can receive the maximum limit again.

- Verification: To increase your receiving limit, consider completing your identity verification. This involves submitting personal information such as your name and Social Security number.

- Weekly Limit: Venmo also has a combined weekly receive limit. For verified accounts, it can be up to $19,999.99 per week.

- Instant Transfers: If you want to move funds quickly, be mindful that fees apply for instant transfers.

- Declined Transfers: Some transfers may be declined for reasons not related to the limits. Always check your account status if you face issues.

Daily Versus Weekly Limits

When using Venmo, it’s important to know the difference between daily and weekly limits.

Daily Limits

Venmo doesn’t set a strict daily limit on how much you can send overall. Instead, there are caps on specific actions. Here’s a quick look:

- Payments: You can send up to $4,999.99 per day.

- Purchases: Daily spending is capped at $3,000.

- Transactions: There’s a limit of 30 transactions per day.

Weekly Limits

Venmo has more defined weekly limits that vary based on your verification status:

| Status | Weekly Limit for Personal Payments | Weekly Limit for Bank Transfers |

|---|---|---|

| Unverified Account | $299.99 | $999.99 |

| Verified Account | $60,000 | $19,999.99 |

- For bank transfers, unverified users can only transfer small amounts, while verified users can handle larger sums.

- Different transaction types accumulate against these limits within a rolling week.

Remember that your activity may be monitored, and limits can change based on your usage and account history.

Maximum Transfer and Transaction Amounts

For daily transactions, Venmo does not strictly define a set limit, but it allows you to spend up to your weekly limit within a single day. For verified accounts, this daily amount could be as much as $4,999.99.

Key Transaction Limits:

- Venmo Debit Card: Spend up to $2,999.99 per transaction.

- Daily Spending Cap: Up to $3,000 daily.

- Weekly Spending Limit: Total of $7,000.

You can make up to 30 transactions in one day with the debit card, giving you multiple options for payments.

Venmo Receiving Limit and Restrictions

When it comes to receiving money, Venmo does not impose a strict daily or weekly limit. You can receive as much as you want. However, transactions may be subject to review and could be declined if Venmo thinks they violate their policies.

Points to Remember:

- For verified accounts, the monthly limit is $6,999.99.

- Payments can be declined for reasons other than reaching limits.

Venmo Debit Card and Bank Transfer Limits

With the Venmo Mastercard Debit Card, you have specific spending limits to be aware of:

- Per Purchase Limit: You can spend up to $2,999.99 on each purchase.

- Daily Limit: You can spend a maximum of $3,000 every day, resetting at 12 AM CT.

- Weekly Limit: The total spending limit for a week is $7,000.

- Transaction Count: You can make up to 30 transactions each day, which also resets each day at midnight.

These limits are important for budgeting and ensuring that you can use your card without interruptions.

ATM Withdrawal Caps Per Day

When using the Venmo Debit Card at ATMs, there are specific caps:

- Daily ATM Withdrawals: You can withdraw up to $400 each day.

- Over-the-Counter Withdrawals: If you go to a bank, the limit is the same $400 per day.

- Cash Back Limits: You can also receive cash back when making purchases, but this is included in your daily withdrawal limit.

ATMs can have different policies and fees, so it’s always good to check beforehand.

Bank Transfer and Instant Transfer Limits

Venmo has varying limits for bank transfers, depending on your account status:

- Weekly Limits: For verified accounts, you can transfer up to $10,000 per week using a bank.

- Instant Transfers: If you want to move money instantly to your bank, the limit is $50,000 per transaction.

- Unverified Accounts: If your account isn’t verified, the limit for bank transfers drops to $999.99 per week.

Venmo Fees and How to Increase Your Limits

When using Venmo, it’s essential to know about transaction fees and how to boost your limits. Knowing this information can help you make the most of your Venmo account without unexpected costs or restrictions.

Venmo Instant Transfer Fees and Standard Transfer Costs

Venmo offers different types of transfers, and the fees can vary. For standard bank transfers, there are no fees. However, if you opt for instant transfers to your bank, a fee of 1.75% applies, with a minimum fee of $0.25.

Here’s a quick breakdown:

- Standard Transfer: Free, takes 1-3 business days.

- Instant Transfer: 1.75% fee (min. $0.25), instant access to funds.

- Credit Card Payments: A 3% fee for sending money using a credit card.

Keep these fees in mind when making transactions. They can add up, especially if you frequently use instant transfers. Always check your balance and planned transfers to avoid surprises.