Can you use your Venmo card at ATM? Read on to get all the information you need, along with why your card might not work.

There’s no denying the huge role that ATMs have in our lives. And with online wallet services, like Venmo, rising to fame, it’s a bonus to have the two working together.

However, this isn’t a privilege that all online services offer. But can you use your Venmo card at ATM?

Read on to find out!

RELATED READ: 9 Reasons Your Venmo Card is Not Working at ATM & How to Fix It?

Can You Use Venmo Debit Card at ATM?

Yes, you can use your Venmo card at ATM. However, you can only use it to make cash withdrawals. In addition, it only works with ATMs that have Mastercard®, MoneyPass®, Cirrus®, or PULSE® acceptance marks. And like any other debit card, you’ll use your PIN to access all those services.

Now that we’ve given you a broad answer, it’s time to dive into more details!

Withdrawing Money Using Venmo Card

The Venmo card you apply for is like any debit card you get from a bank. It’s a Mastercard service that you can use anywhere where Mastercard is accepted. However, this is limited to the United States. So you can’t use your Venmo card for abroad purchases, even online ones.

You can easily withdraw cash using your Venmo card from any ATM with the acceptance marks we’ve mentioned before. However, when you apply for the card, you’ll be asked to activate it using a PIN. So, naturally, you’ll have to enter the PIN every time you use your card for a financial process.

It’s worth mentioning that you may pay an extra fee when withdrawing money from an ATM. In general, the ATM withdrawals fee is about $2.50 per transaction. However, some banks and ATMs charge a different price for themselves, so you may end up paying two extra fees. That’s why it’s essential to ask about the ATM’s fee before withdrawing money.

But, lucky for you, there’s an exception to this rule. If you withdraw cash from your Venmo balance using a MoneyPass ATM, you won’t have to pay any extra money.

Another essential point you should know is that Venmo has a daily withdrawal limit. To elaborate, you only have the freedom to withdraw $400 per day. Although this is more than enough, some people don’t appreciate the restrictions.

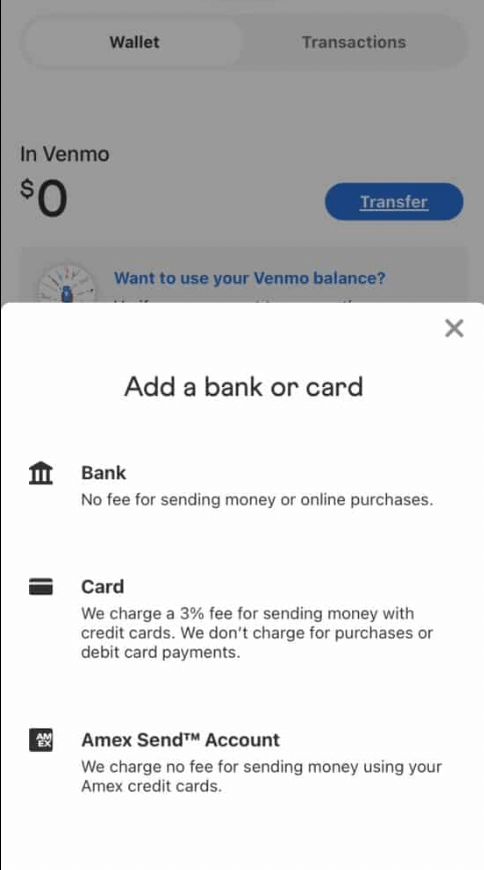

Adding Money to Your Account Using Venmo Card

Many banks allow their customers to add money to their accounts via ATMs. However, Venmo doesn’t have that option. The only current way to add money to your account is through the Venmo application. It’s also worth mentioning that there isn’t a way you can add physical cash to your account.

Venmo Card Not Working at ATM

If you want to use your Venmo card to withdraw money from an ATM, but it isn’t working, it could be for many reasons. Here’s a brief roundup about some of them.

1. Wrong PIN

You might think it’s weird, but entering the wrong PIN is the most common reason Venmo cards fail to work at ATMs. This is mainly because most people have more than one card, and they all have different PINs. So, confusion might occur.

Luckily, if you entered the wrong PIN, your card will work once you enter the right one, so you have an easy fix. However, if you’re sure you entered the correct PIN, keep reading.

2. Card Isn’t Activated

If you only recently got your Venmo card, you should know that you have to activate it before using it to make any withdrawal or transaction. If you’ve ignored this step, then you won’t be able to use your card anywhere.

Lucky for you, activating the Venmo card is pretty straightforward. All you have to do is scan the QR code written on it with your mobile’s camera or the Venmo application’s code scanner.

3. Expired Card

All debit cards have an expiry date, and the Venmo card is no exception. Your card won’t work at any ATM if the date comes by and you don’t notice. To make sure, you should look at the date on your card. That said, it’s worth mentioning that you can use your card throughout the entire expiry month.

In other words, if the expiry date on your Venmo card is 02/22, then you can use your card till February ends.

4. Card Is Locked

If you enter the incorrect PIN many times, Venmo might lock your card till further notice to ensure financial security.

Also, many new users don’t know how to deal with the Venmo application and might accidentally block their cards. In that case, you can open your card settings on the Venmo application and disable the block.

Frequently Asked Questions

Are There Fees for Applying for the Venmo Card?

No, there aren’t. You can apply for the Venmo card and have it shipped within 15 days without paying extra fees.

How Can I Apply for the Venmo Card?

All you have to do is open your Venmo app, click on the “Cards” tab, and follow the steps to get your Venmo Debit Card. First, they’ll ask you for personal information to verify your identity; then, you’re good to go.

Can I Apply for an Extra Card for Someone Else on My Venmo Account?

No, you can’t. Since the Venmo card is linked directly to your Venmo account, you only have the freedom to apply for one card, and it must be in your name. If it’s activated, you can’t apply for another one.

To Wrap Up

Many Venmo users don’t know whether they can use their cards at ATMs. To sum it up, you can use your Venmo card at any Mastercard ATM to withdraw cash.

However, you’ll pay an extra fee. If you don’t want to, you can look for a MoneyPass ATM. Finally, you can’t use your Venmo card to add money to your account through ATMs.

Did you find this article helpful? Let us know in the comments below!